Trilhos do Desenvolvimento: as ferrovias no crescimento da economia brasileira, 1854-1913 (Ed. Livros de Safra, 2018)

[Recommended for reading during pandemic quarantine (!)— Marcelo Toledo in Folha de S.Paulo]

Order Against Progress (Stanford University Press, 2003), is now available in Portuguese as Trilhos do Desenvolvimento (Ed. Livros de Safra). [Ebook at Livraria Cultura, amazon.com.br and amazon.com}. Investments in railroads in the second half of the nineteenth century were the single most important factor in Brazil's transition from relative economic stagnation to growth around 1900. Railroads provided large savings on transport costs, releasing scarce resources for other sectors of the economy. The government's policy of contingent subsidy mobilized capital to build railroad lines, attracting investment within Brazil and from abroad. While this provided investors with a relatively secure return, the government's regulation of rates capped the profits of foreign companies, and captured most of the economic surplus from lower-cost transport for Brazil.

The Brazilian edition is made possible by the initiative and generous support of Guilherme Quintella. It offers findings from quantitative economic history that bear directly on discussions of the future of infrastructure policy and sorely-needed investments in Brazil.

The book launching event at Insper in São Paulo included panel discussions linking economic history and current policy, with welcomes by Insper founder Cláudio Haddad and Insper president Marcos Lisboa. Discussants included Samuel Pessôa, Sérgio Lazzarini, Paul Procee (World Bank), Júlio Marcelo de Oliveira (Ministério Público), Fernando Camargo (Tribunal de Contas da União), and Fábio Coelho Barbosa (Finance Ministry): "Desafios e entraves para o desenvolvimento do transporte brasileiro;” summarized in Revista Ferroviária (August, 2018).

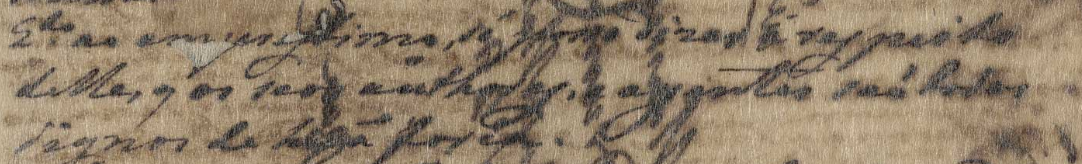

Elio Gaspari note on Trilhos do Desenvolvimento in Folha de S.Paulo and O Globo (September 2018); Marcelo Toledo review of Trilhos do Desenvolvimento (October 2018) and blog post (August 2018), in Folha de S.Paulo; Samuel Pessôa, "Trilhos do Desenvolvimento: nosso subdesenvolvimento tem sido construído por nós mesmos, não por gringos," in Folha de S.Paulo (August 2018); interview with João Soares in Deutsch Welle (Brasil), “Brasil hoje não tem posição no mercado que tinha no século 19,” (September 2018); interview with Gustavo Altman for JOTA (November, 2018).

Presentation on Trilhos do Desenvolvimento at Tribunal de Contas da União (TCU) (Brasília) [with participation by Júlio Marcelo de Oliveira, prosecutor from the Ministério Público; Carlos Pio, Secretaria de Assuntos Estratégicos da Presidência da República; and Fernando Camargo, head of the TCU's Initiative on Efficiency and Productivity].